Traditionally, banks have focused on building trust and security with their distribution network of branches. They have, by and large, not been able to keep pace with the improvements in customer experience observed across other consumer businesses. As Nubank has shown in Brazil, banks need to fundamentally rethink what it will take to pivot to a more customer-centric business model, aggressively go beyond their branch-based distribution networks, and at least invest in operations transformation which can bring back the returns to scale. This will require a tremendous shift in focus from strategy to execution across all dimensions – of people, processes and technology.

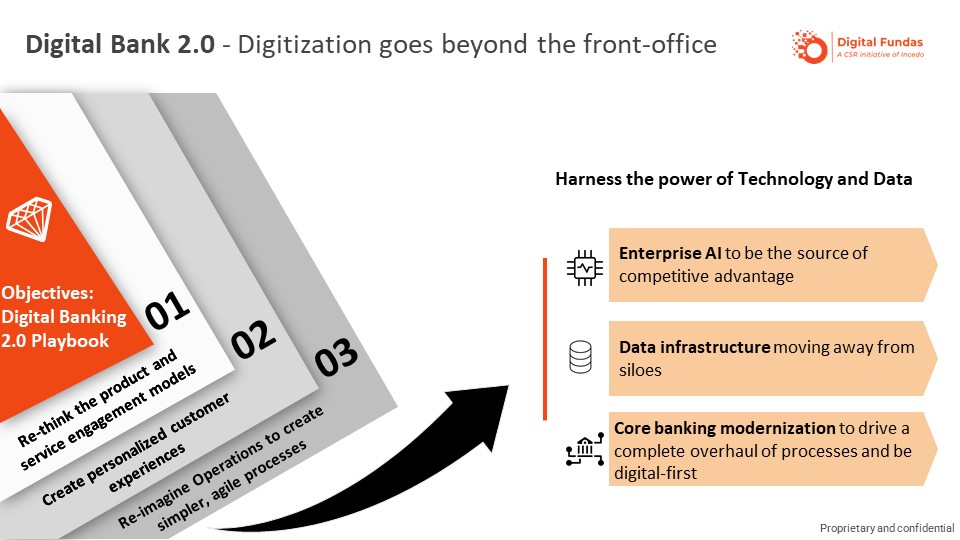

I believe the Digital Banking 2.0 playbook must include the following objectives:

Data and technology will undoubtedly be the backbone on which these objectives will hinge while the execution process is on.

A comprehensive technology strategy for a bank must include the following: