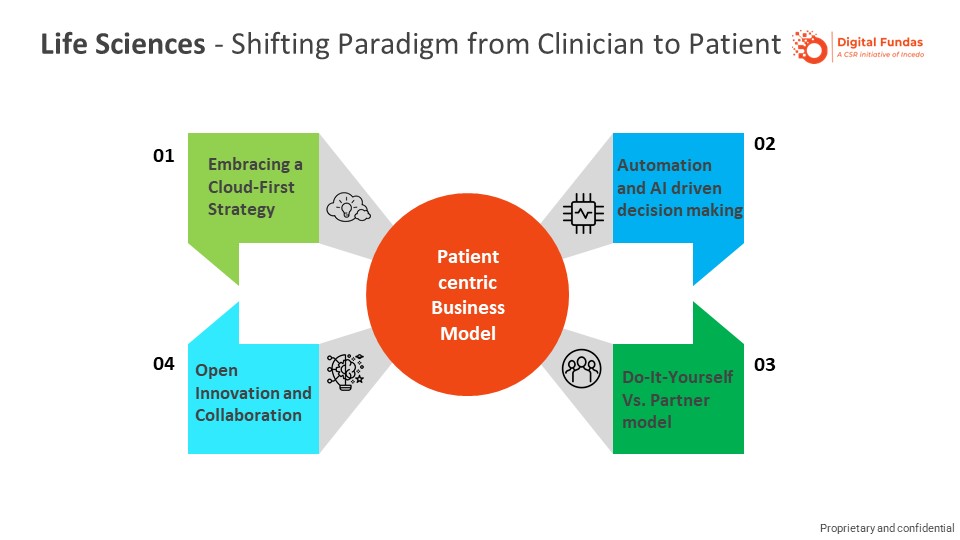

‘What business are you in?’ – This question, raised by Professor Theodore Levitt in a Harvard Business Review (2006) article, is a fundamental one that life sciences manufacturers are faced with. It lies at the heart of the digital transformation taking place in this industry. Pharmaceutical manufacturers have traditionally built businesses focused on product superiority, targeting clinicians (their ‘customer’) who have patients (the end consumers of their products). With digital becoming all-pervasive and with the industry moving towards specialty and personalized treatments, understanding the needs of the end consumer has never been more essential, in the process leading to a redefinition of who their end customer should be – The Patient!

New and non-traditional entrants in the life sciences industry, many of whom are digital-native companies, add another dimension of disruptive forces at work, driving the need for digital transformation to be the centerpiece of a pharmaceutical company’s future-state strategy. The pharmaceutical industry, unlike other sectors, has historically been a laggard in digital adoption. A 2018 Deloitte-MIT Sloan Review study found that less than 20 per cent of pharmaceutical companies had currently taken decisive and bold moves to take advantage of digital capabilities. Together, these developments present a tremendous opportunity for forward-looking companies to shape their digital agenda to address their primary concern of serving patients better.

Digital presents new ways to Life Sciences companies to provide value to customers (patients) and create a competitive advantage for themselves. Harnessing data and leveraging cloud-based technologies, combined with a deep understanding of customers and their unmet needs, offer new possibilities for innovation in R&D and delivery of differentiated multi-channel patient engagement programmes for improving patient outcomes.

Linear methods of clinical research and discovery for new therapies face the continuing pressure of increasing R&D costs and shorter product (‘medicine’) life cycles.

While placebo-controlled clinical trials remain the gold standard, synthetic control arms offer new ways of assessing new treatment interventions. The US Food and Drug Administration’s (FDA) approval of Brineura from Biomarin for Batten disease based on a synthetic control study, and its accelerated approval of Alecensa from Roche for a specific form of lung cancer give new hope and possibilities for sustained innovation in this space.

This method of clinical trial represents a notable shift toward the use of real-world evidence (RWE). Instead of using conventional data collection methods using patients in a trial, synthetic control arms model those comparators using real-world data. The use of real-world data from sources – including electronic health records of patients, patient-generated data from medical equipment, patient registries and historical trial data – makes possible equivalent and useful comparisons.

When combined with advanced analytics, including machine learning and natural language processing (NLP), equivalent and useful trial insights become available, accelerating the pace of clinical trials while reducing costs.

The retail world is full of examples illustrating the importance of embedding technology that fuses a consumer’s physical and digital experiences. At the centre of creating such a composite experience is the ability to leverage data and the right digital channels to personalize, target and tailor a customized experience for each consumer.

For pharmaceutical brands, an urgent need to uncover the consumer’s (patient’s) unmet needs and effectively partner with the stakeholders in the healthcare system (clinicians, nurses, payers, patient advocates) to deliver a similar patient-at-the-centre experience is an enabler for differentiated service models.

Take, for instance, the market access programmes for patients. As the touch points between patients and the partners supporting the patient’s care become digital and come through multiple sources, it results in an inconsistent, high-friction, disconnected and burdensome experience for patients engaging with a brand for their needs. The problems include repeating, confusing interactions for the patient as a result of lack of coordination among the touch points (HCP/practice, access, contact centres, insurance) and lack of a feedback loop, and the poorly understood patient journey leads to disconnects in service interactions. When one combines the scale of such operations that can typically include 500,000 or more patients on a programme – involving multiple touch points that include a 1000+ person contact centre – across brands and therapeutic areas, the problem quickly becomes very complex.

The need and opportunity for pharmaceutical brands lie in solving this problem and, in the process, gaining competitive advantage using an integrated framework that combines data science to surface new insights from service interactions. They can then go on to redesign the patient experience, effectively incorporating desirable changes in the patient’s journey.