Digital transformation in wealth management has been an important theme for a long time but the industry has been relatively slow in adopting digital technologies. The wealth management industry has been dealing with challenges in the form of changing business models, disintermediation and disruption from fintechs, increasing client expectations, revenue pressures due to zero commissions and alternate fee models. Wealth management was front and centre of the volatility in the aftermath of the Covid-19 pandemic. The disruption caused by the pandemic has further accentuated the VUCA environment, and the need and push for digitization have become more and more important.

I have both observed and participated in the digital transformation that has been happening in this industry over the past decade, initially helping drive strategy and transformation for Fidelity’s international business. Over the last three years, at Incedo, I have been working with some of the leading players across the wealth management industry value chain.

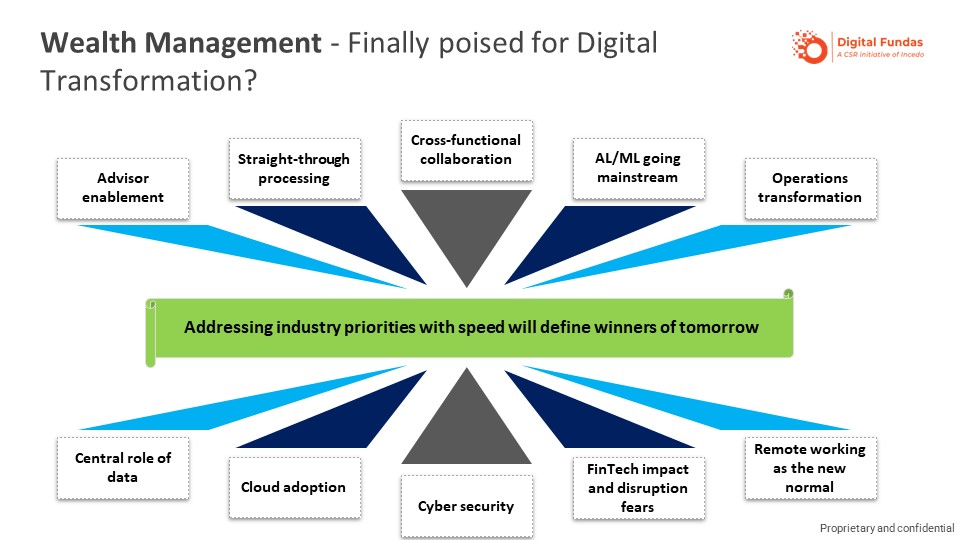

Ten priorities for digital transformation in the wealth management industry, especially in the wake of the Covid-19 pandemic:

Overall, the wealth management industry has been able to adapt very well to the Covid disruption. Digital transformation was a trend already underway in the wealth management space, and the pandemic simply gave a push to the implementation efforts and adoption of such initiatives. The success of digital transformation is as much a factor of successful technology implementation as it is of orienting the organization towards a digital mindset. How wealth management firms shape their organizational culture will determine the success or failure of their transformation initiatives.