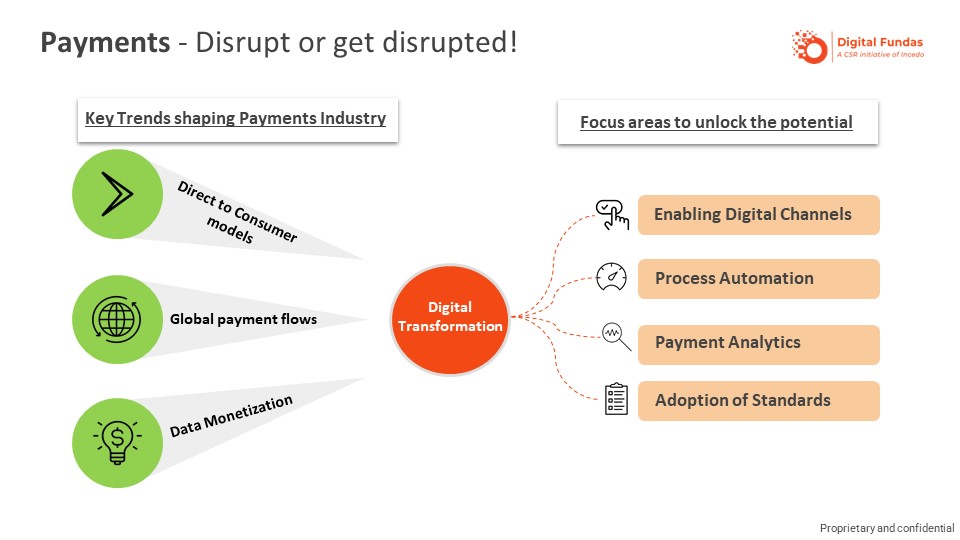

To say the payments industry is going through disruption is certainly not a hyperbole these days. The fundamental shifts in how commerce gets done have begun to impact the way payments have been done all these years. On the one side, the payments industry has seen the entry of diverse fintech players, including giants like Facebook and Tencent, in addition to the start-ups that are presenting increased competition for banks and corporations. On the other hand, the threat from fintechs is being further fuelled by rapidly evolving customer expectations, which continue to push the boundaries for the industry as a whole. It is increasingly apparent that the payments marketplace will look fundamentally different a decade from now. There will be new form factors, real-time infrastructure, greater levels of integration with social media and e-commerce, to name a few of the changes. In effect, the revolution that has completely disrupted the consumer payments industry over the last decade or so is finally coming to take into its fold the corporate payments industry, too.

Banks and corporations have started responding to the call of digital, and the payments processing industry is currently going through a wave of infrastructure modernization. I see significant technology investments by CIOs across firms that are setting the stage for the next wave of digital transformation. The payments industry will look fundamentally different a few years from now. By adopting digital channels, embracing automation, adopting open standards and making smart bets in technology, banks and corporations can emerge as winners in the payments marketplace.